Perhaps you’ve heard rumblings about pay transparency laws. The issue – embraced by some states, ignored by others – always feels like tomorrow’s problem, something not worth worrying about yet.

Unfortunately, tomorrow has arrived.

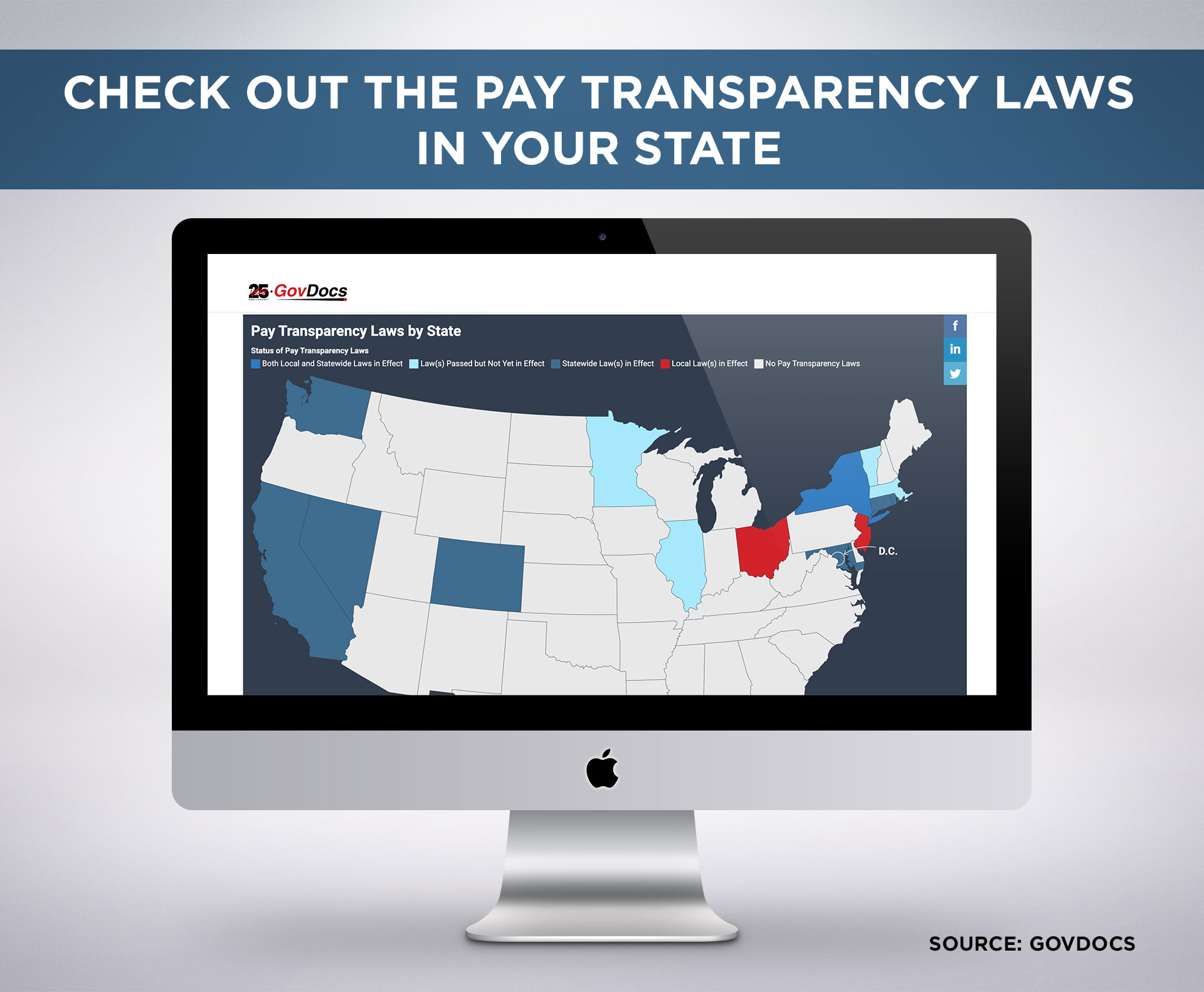

This is no longer a “Washington-only” issue. More and more states are getting on board with the idea. Given that constantly evolving target, and given the potential for extreme financial penalties your company can incur for noncompliance, we highly recommend a blanket approach to pay transparency.

In short: adhere to the tenets of the strictest jurisdiction and apply it across all 50 states. You won’t enjoy it, but we’re confident you’ll enjoy a lawsuit even less.

So what does that look like?

- Type of pay offered (hourly, cpm, etc.)

- Annual salary range estimate, from minimum to maximum

- Description of all compensation and taxable benefits (insurance, bonuses, paid time off, etc.)

- Date application window closes, or statement that job opening is ongoing

- For 1099 positions, a statement that your position offers no taxable benefits (1099, no taxable benefits available)

Currently, thirteen jurisdictions have passed pay transparency laws, a number of which become active throughout this next year. Five more feature laws that require some disclosures but not others. More will join them.

In terms of penalties, let’s look at Washington, one of the more extreme examples. In Washington, for every applicant who applies to a job without transparent pay details, your company can be fined $5,000. Now imagine how many applicants you get each week. They don’t even have to be qualified to apply, so long as they put an application in.

Hopefully, the seriousness is coming into focus.

We are here to help you through this process, which we understand will be a big undertaking. But as you can see, the consequences are worth avoiding. It is imperative you update all your ads as soon as you can, regardless of state with an annual pay range and clear definition of benefits.

Some more notes:

- The annual pay range can be broad but must include a minimum and maximum

- There is a “good faith” element at play that your advertised pay range should be actual or what you intend to pay for the position

- Laws apply to any job posting, not just paid ads

- Cannot use phrases such as “average pay” or “$xxxx per week and higher”; it must be a true range

- Document how you came up with pay range

- 1099 jobs may need to include average pay ranges on a per-state and per-contract basis. Get advisement from your legal counsel where applicable

- CPM and percentage of gross alone are not accepted descriptions. You can list it but you must also include a pay range

As you can see, this is a complicated but also very serious issue. The more informed you and the more help you have, the more likely you are to avoid severe penalties in the future. Please let us know if you have any questions. We’ll be more than happy to hold further discussions on this ever-changing topic.